PRACTICE AREAS

RESOURCES

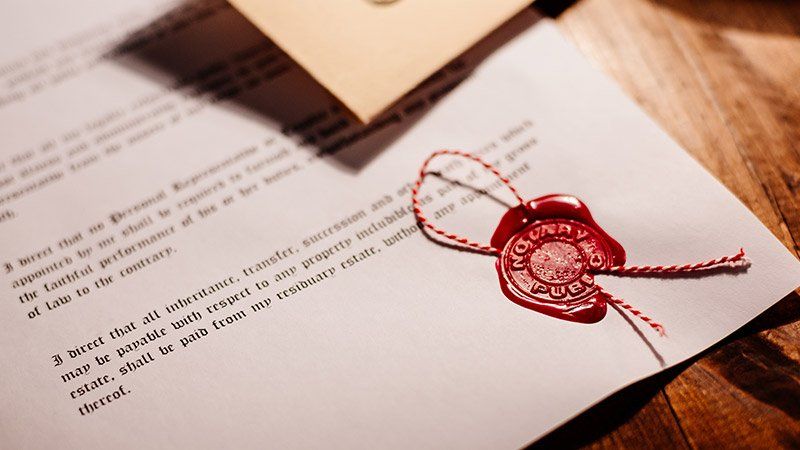

Probate

A formal probate is a court supervised process that transfers legal title of property from someone who has died to his or her heirs or beneficiaries. Probate also determines whether a will is valid. In a probate case, an executor (if there is a will) or an administrator (if there is no will) is appointed by the court as personal representative to collect and marshal the assets, pay the debts and expenses, and then distribute the remainder of the estate to the beneficiaries (those who have the legal right to inherit), all under the supervision of the court. The entire probate case can take between 9 months to several years to accomplish. The determination of how long a probate needs to be open is determined by the complexity of the probate.

Often, a formal probate can be avoided to obtain title of property belonging to a deceased person. Some examples of avoiding a formal probate include the following:

Collection of Small Estates by Affidavit

The affidavit procedure provided in Probate Code Sections 13100–13116 can be used to collect the decedent’s personal property when the gross value of the decedent’s real and personal property in California does not exceed $150,000.00. See Probate Code Section 13100(a). The affidavit procedure cannot be used to transfer real property and specific requirements must be met.

Filing A Petition to Determine Succession to Real Property and Personal Property if the Deceased Person left $150,000.00 or less in Real property and Personal property

This petition under Probate Code Sections 13150–13158 is the most commonly used procedure for transferring a decedent’s interest in real property or real and personal property in California with a gross value not exceeding $150,000.00 as of the date of death. Refer to Probate Code Section 13151. The value must be shown by an inventory and appraisal by a probate referee. The petition may be filed once 40 days have elapsed since the decedent’s death and other requirement in the code must be followed to utilize this procedure.

Filing of a Spousal or Domestic Partner Property Petition

A surviving spouse or Registered Domestic Partner may elect to file a petition under Probate Code Section 13650 requesting all or part of the estate is property passing to the surviving spouse or Registered Domestic Partner. This petition is a shortened probate, and takes much less time than a formal probate. Legal fees are usually much lower for a spousal property petition than a full probate. If a decedent leaves a will and the only beneficiary is the surviving spouse or domestic partner, both community property and separate property can be transferred by a spousal property petition. If the will has other beneficiaries, a probate may be needed for the assets being transferred to those beneficiaries. If there is no will, the estate will be transferred under the laws of intestate succession and community property of the decedent can be transferred to the surviving spouse or registered domestic partner under this process. If the decedent left separate property, a formal probate may be required. This process requires strict compliance with the Probate Code requirements.

Title of Ownership may avoid a Probate

It is also possible that title to property may pass directly to beneficiaries because of how title to property is held. For example, property in Joint Tenancy with the Right of Survivorship will generally pass to the survivor. Contracts with named beneficiaries will pass to designated beneficiaries. Examples of this are life insurance proceeds, retirement benefits, death benefits, and trusts.

If you need to probate a will or require legal probate services, Sklar & Sklar can help. At Sklar & Sklar, our attorneys represent clients throughout Riverside County, including, but not limited to: Palm Springs, Cathedral City, Rancho Mirage, Palm Desert, La Quinta, Indian Wells, Indio, Coachella, Joshua Tree, Morongo, Banning, Desert Hot Springs, Beaumont, Moreno Valley, Thousand Palms, Bermuda Dunes, and Twentynine Palms.

For more information, contact us and schedule a consultation.